The Future of After-sales Service

After-sales service has many definitions starting with the broad view that it’s all the help and information a company provides to its customers after they have bought a product. A narrower definition would be offering periodic maintenance or repair of equipment during and after a warranty period. This article focuses on that narrower definition to provide an outlook for the future of maintenance and repair in the valve industry.

THE BEGINNINGS

To predict the future, it’s usually best to look backward to understand how we got to where we are today. Valve maintenance in the past was simple. Factories typically had a dedicated team of pipefitters and a storeroom full of pipe, flanges, gaskets, seals, insulation, packing and valve repair parts. Repair work was a skilled trade that did not require a higher education. Pipefitters usually started as apprentices and learned diverse skills such as welding, machining and valve repair on the job. It was hard work, but a career usually lasted through retirement, which included a pension. By the 1940s, these positions were lucrative since one in three jobs in the U.S. was in manufacturing.

However, all good things come to an end. Factory owners became squeezed by tighter regulations and higher costs from labor rates, benefits, pension plans and environmental regulations. Global competition drove pricing and profitability down. The easiest and fastest way to stay competitive became cost cutting.

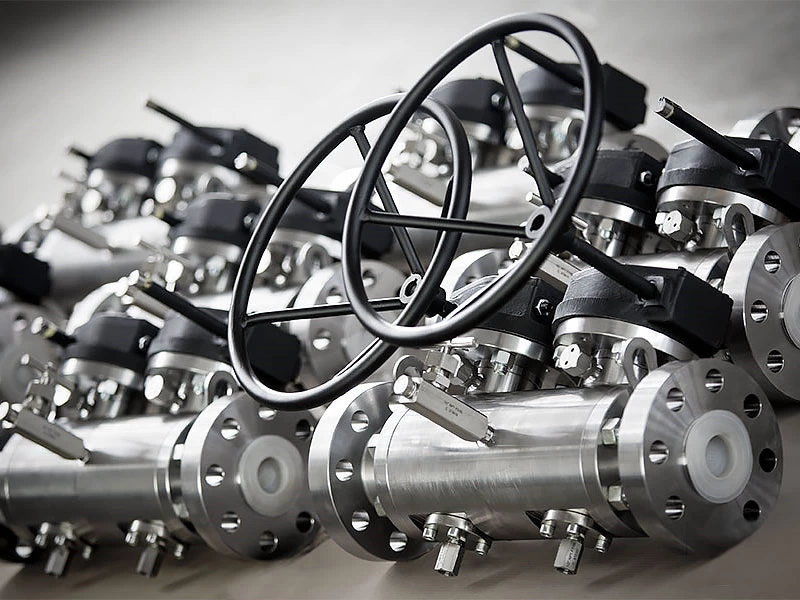

The U.S. industry reacted by outsourcing. Companies focused on defined core businesses and outsourced the rest. Storerooms were cleared out, and staff was reduced. Outside service companies appeared to fill the void in maintenance needs. Also, in the continuous search to remain competitive, valve production moved across the border and overseas. Valve manufacturers looked for growth opportunities by expanding their focus beyond product sales and into repair services.

This evolution led to where we are today: a mix of OEM manufacturers competing against service companies in the world of valve repair. Some reports estimate that one in 11 U.S. jobs today are in manufacturing. Statistics also show that many industry jobs are moving to service industries.

But these statistics can be misleading when it comes to maintenance and repair. Valve repair work itself has not gone away. However, some of the repair work formerly done by factory employees is now done by outside service providers.

Meanwhile, market pressures continue to drive change. Factory owners are squeezed even tighter by higher costs, health care, tighter regulations, global competition, higher borrowing rates and longer payment terms. The solution is more cost cutting, which impacts all of today’s businesses including service companies. Previously unthinkable practices are now accepted and justified in places; maintenance budgets are slashed and run to failure is a common practice.

To grow, or simply just to survive, OEM manufacturers and service companies are looking at diversifying. Field inspections and surveys, predictive maintenance tools, engineering and purchasing support are all horizontal service opportunities for everyone.

The ways to grow, then, are there, but industry is burdened with lack of awareness of where those opportunities lie. Also, the next generation generally has a negative image of factory and technical work. At the same time, the U.S. Bureau of Labor Statistics reveals that the entire workforce is aging in this country. For example, there are just as many people past retirement age working in the fabricated metals product industry as there are employees ages 20 to 24. More than half of the employees in this industry are 50 years or older. This is another reason that experience and needed technical know-how are declining throughout the valve industry.

LACK OF SKILLS

As far as what this aging workforce means today, Mark Twain explained it best when he said, “Good judgement comes from experience, and experience comes from bad judgement.” We risk being able to transfer knowledge and the experience learned over time. We learn from our mistakes. But transferring our valuable know-how, or tribal knowledge, is critical to avoid repeating the mistakes of the past. This tribal knowledge is unwritten information not commonly known including what’s needed to produce a quality product or service. Studies by consulting companies reveal that as much as 70% of the knowledge we need to produce a product or service is undocumented. An additional 20% is documented, but not in a digital, easily retrievable format.

With an aging workforce and limited possibility to transfer the tribal knowledge, the outlook seems bleak. But it can get worse. The market is saturated with low-cost valves that are less expensive than repairing existing valves. Cost cutting has its limits so the breakeven size for replace versus repair is increasing. Independent repair shops are struggling to compete against OEM manufacturers that can influence customer choice through parts pricing and minimizing parts availability. Also, whether it’s a truth or misperception, some believe the next generation has a lower work ethic and limited desire for “dirty” jobs.

LOOKING AHEAD

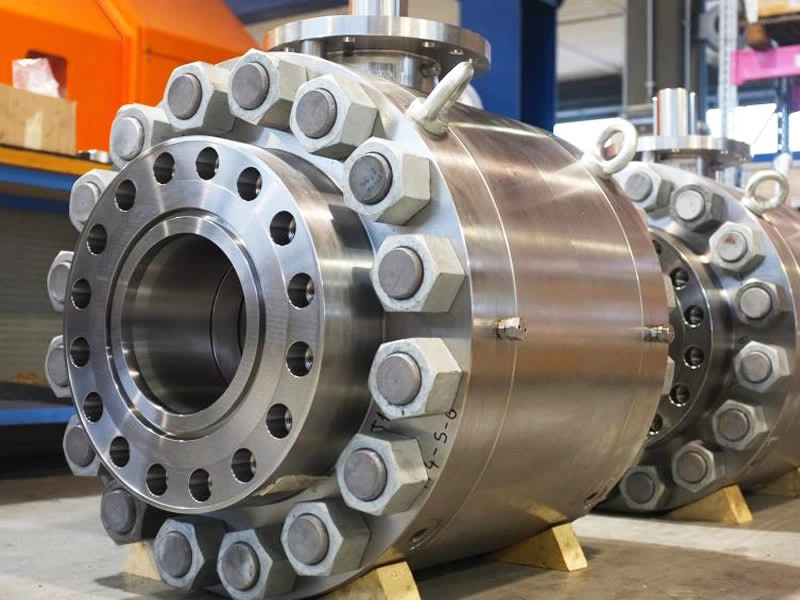

Is it possible to survive in the future then? The answer is yes; we just need to focus on the right areas. The valve service industry will not go away, but it needs to adapt. Areas of opportunity include niche markets such as specialty products and applications and servicing higher value products such as control valves, pressure relief valves, cryogenic, fire and fugitive emission testing and products. New areas of opportunity include product dismantling and disposal services.

A critical element for future growth will be key performance indicators (KPIs). All of us live with KPIs, including our customers. To survive requires understanding our customers’ performance metrics—knowing how they measure success. We must talk their language and find ways to help them achieve those metrics. Common service indicators are numbers such as mean time between repairs, process interruptions, production rates, safety and environmental goals, outage cycle time, etc.

To guarantee service business in the future will require innovation; we must find creative options that can provide savings for customers such as valve leasing programs. We must quickly respond in the run-to-failure world. Our businesses must spread horizontally as customers continue to cut costs and look outside for services. Opportunity may lie in procurement and supply-chain management services, turn-around management, accounting, information technology and training programs.

Technology brings opportunities; embracing and employing technology will help us flourish. The nation is at the cusp of the fourth industrial revolution—smart factories with autonomous systems and machine learning using big data and the Internet of Things (IoT) is here. A recent study by a global consulting firm revealed that 60% of companies claim to have active IoT programs, but only 5% say they have commercialized results. Yet big data brings several opportunities. For example, installed base information of product, performance and maintenance history can help customers plan future maintenance expenses. Web conferencing allows greater distance between product expertise and point of use. In the next five years, the number of IoT-connected devices is projected to grow 250%. We see this growth commonly today in coffee makers, televisions, automobiles, refrigerators and washing machines. But the future also includes valves that can communicate their health and status. As with other devices, use of IoT technology in valves will increase along with the need for the required level of knowledge and skills for service.

The biggest opportunity for the future, however, is the simplest: product knowledge. This is the key to survival. Companies must learn to train, train and then train again to ensure they have the skilled workforce they need—a workforce that knows the products and what they can do. This training will maintain the expertise we need so badly in the valve industry. In the end, this product knowledge means a better bottom line.